Rules of Origin in Bilateral and Regional Trade Agreements

Bilateral and regional trade agreements have proliferated around the globe in recent years. In modern times, particularly after World War-II, countries collaborated and created the General Agreement on Tariffs and Trade (GATT) on a multilateral platform, which even today acts as a guiding document for finalizing trade deals. Article XXIV of GATT enables WTO members to grant special treatment to one another by establishing a customs union or free-trade association. Limited progress in the World Trade Organization's (WTO) Doha negotiations shifted attention towards bilateral and regional trade agreements. As per WTO’s statistics, there are 355 regional trade agreements in force as on date, and majority of the world trade takes place under these agreements.

Under a trade agreement, duty concessions are required to be extended only to such imported goods which are ‘made in’ the exporting country. Each FTA contains a set of rules of origin, which prescribe the criteria that must be fulfilled for goods to attain ‘originating statuses in the exporting country. Such criteria are generally based on factors such as domestic value addition and substantial transformation in the course of manufacturing/processing. For instance, the originating criteria finalized under a trade agreement could be domestic value addition of minimum 35% plus substantial transformation through Change in Tariff Sub-Heading (CTSH).

1) Illustration – Different types of originating criterion

| India ASEAN FTA | 35% + CTSH |

| SAFTA | NOM 60% + CTH, PSR, 10%≤relaxation to LDC, 5% to SL |

| ISLFTA | NOM ≤ 65% + CTH |

| India-Malaysia CECA | 35% + CTSH or PSR |

| India-Singapore | 35% + CTSH or PSR |

| Indo-Nepal | NOM 70% + CTH |

Note: CTH: Change in Tariff Heading (4-digit level); CTSH: Change in Tariff Sub Heading (6-digit level); NOM: Non-Originating Material; PSR: Product Specific Rules

2. Technical Terms used in Rules of Origin

A. Goods Wholly Obtained (WO)

Goods produced or obtained entirely in the territory of an FTA party without the addition of any non-originating materials. Examples include live animals born and raised there, mineral products extracted from the ground, food products grown and harvested in the territory of the party (e.g. fruits, grains) or it is a waste that is derived from production in the country of export.

B. Presence of non-originating material

Goods that are produced using non-originating materials, i.e. not Wholly Obtained, are required to undergo substantial transformation in a country for the good to be qualified as originating. This criterion can be met using following method in combination or standalone, depending upon the criteria assigned for a good, -

- (a) Regional or Domestic Value Content (RVC/DVC);

- (b) Change in Tariff Classification (CTC); and

- (c) Process rule.

C. Value Content Method

This rule requires that a certain minimum percentage of the good’s value originates in a country for the good to be considered as originating. The components of value and formula for calculating such value addition may vary from agreement to agreement.

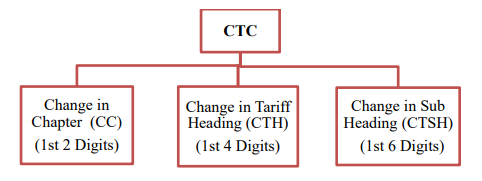

D. Change in Tariff Classification (CTC) Method

To qualify under this origin criterion, non-originating materials that are used in the production of the good must not have the same HS classification (e.g. Chapter level, Heading level or Sub Heading Level as may be required in the Rules of Origin) as the final good. Depending on the Trade Agreement requirements, the good would have to undergo either a Change in Chapter (CC), Heading (CTH) or Sub Heading level (CTSH) in order to qualify for preferential treatment under the FTA. Producers and/ or exporters should know the HS classification of the final good and the non-originating raw materials.

E. Process Rule Method

This rule requires the good which is being considered as originating, to be produced through specific chemical process in the originating country.

Note: Same good may be assigned different originating criteria in different trade agreements.

F. General Rule vs Product Specific Rule (PSR)

Many trade agreements have a single rule for all goods that are produced using non-originating materials. In some agreements, for some or all tariff headings there are Product Specific Rules (PSRs). Depending on the HS classification of the good, it needs to be seen which criteria has been used to claim origin.

G. De minimis

This is also known as tolerance rule. The provision is a relaxation of the rules of origin under certain conditions. It allows a small amount of non-originating materials to be used in the production of the good without affecting its originating status. The provision acts as the relaxation of the rules of origin and the threshold is usually set at around 5-15%.

De minimis is usually applied in the context of the change in tariff classification rule of origin as its utilisation under the value added criterion is prohibited by definition: de minimis threshold cannot be used to increase the value added threshold.

H. Cumulation/ Accumulation

The concept of “accumulation”/“cumulation” allows countries which are part of a preferential trade agreement to share production and jointly comply with the relevant rules of origin provisions, i.e. a producer of one participating country of a trade agreement is allowed to use input materials from another participating country without losing the originating status of that input for the purpose of the applicable rules of origin. Otherwise said, the concept of accumulation/cumulation or cumulative rules of origin allows products of one participating country to be further processed or added to products in another participating country of that agreement. The nature and extent of such cumulation is defined in an agreement and may vary from agreement to agreement. Cumulation can be bilateral, regional, diagonal, etc.

I. Indirect/Neutral elements

Refer to material used in the production, testing or inspection of goods but not physically incorporated into the goods, or material used in the maintenance of buildings or the operation of equipment associated with the production of goods. For example, energy and fuel, plant and equipment, goods which do not enter into the final composition of the product, etc. Depending upon the trade agreement, these elements may be treated as originating or non-originating.

J. Direct Consignment

Most agreements lay down the condition that good claiming originating status of a country should be directly transported from that country to the importing country. Certain relaxation may be provided in a trade agreement, subject to presentation of certain documents.

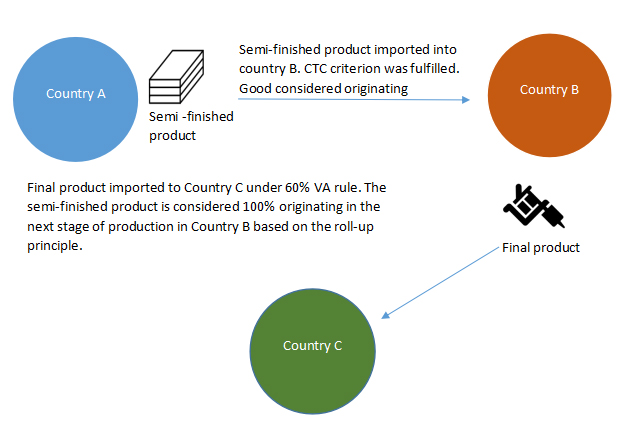

K. Materials Used in Production (Roll-up/ Absorption Principle)

If a non-originating material undergoes sufficient production, the resulting good shall be considered as originating and no account shall be taken of the non-originating material contained therein when that good is used in the subsequent production of another good. The “absorption” or “roll-up principle” allows intermediate products to maintain their originating status when they are used for subsequent manufacturing operations.

Once a part or intermediate material obtains originating status under an FTA, it is considered to be 100% originating when used for further processing even if inputs used for the production of this part or intermediate material were not originating.

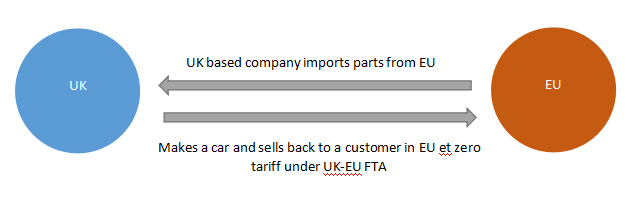

L. Bilateral Cumulation

Bilateral cumulation operates between two countries where a free trade agreement or autonomous arrangement contains a provision allowing them to cumulate origin. Let us consider UK –EU FTA which allows Bilateral Cumulation. This means that any good originating in the EU can be treated as being from the UK, and vice versa, for trading purposes between the two.

Take a car, for example. If a UK company sourced all of the parts from across the EU and then put it all together in a factory in the UK, it could sell it back to a customer in the EU, taking advantage of the preferential zero tariff rate, as if all the bits of the car originated in the UK.

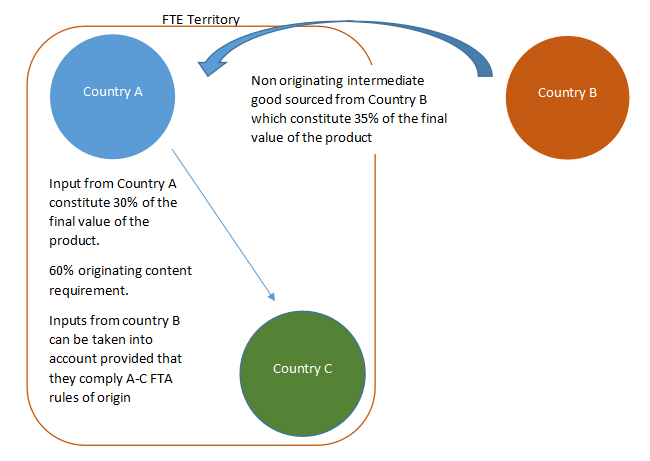

M. Cross-Cumulation - the extension of accumulation to mutual third parties

An arrangement in which each Party has a trade agreement that establishes or leads to the establishment of a free trade area with the same non-Party, the territory of that non-Party shall be deemed to form part of the territory of the free trade area established by such Agreement, for purposes of determining whether a good is an originating good under this Agreement.

AThis is also referred to as Third party cumulation or extended cumulation. It allows to use inputs from a third party country which is not a member of the applicable FTA and consider them originating provided that they meet the rules of origin under the relevant trade agreement. Cross cumulation is the most flexible type of cumulation of originating inputs and is often limited to certain tariff Headings, Subheadings and codes or to certain types of products only.

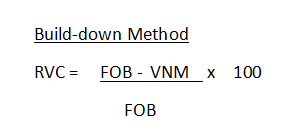

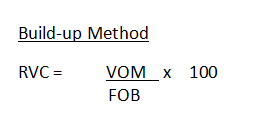

N. Determination of Regional Value Content

The Regional Value Content shall be calculated as follows:

Where:

RVC -- Regional value content, expressed as a percentage;

FOB - Free-on-board value of the good;

VNM-- Value of the Non-Originating Materials.

Where:

RVC -- Regional value content, expressed as a percentage;

FOB - Free-on-board value of the good;

VOM-- Value of the Originating Materials.

O. Transaction Value

Transaction value means the price actually paid or payable for a good or material with respect to a transaction of the producer of the good, adjusted in accordance with the principles of paragraphs 1, 3 and 4 of Article 8 of the WTO Customs Valuation Agreement to include, inter alia, such costs as commissions, production assists, royalties or license fees.

P. Set Criterion

A set, as referred to in General Rule 3 of the Harmonized System, shall be considered originating, provided that:

- All the component goods in the set, packaging materials and containers, are originating; or

- Where the set contains non-originating component goods, packaging materials or containers, the value of the non-originating component goods, packaging materials and containers for the set does not exceed 65% of the transaction value of the set.

- The value of non-originating component goods, packaging materials and containers shall be calculated in the same manner as the value of non-originating materials.

2. Who claims FTA preference?

The importer or buyer claims the FTA preference when clearing customs for import but needs to rely on information provided by the exporter in the certificate or declaration. The importer may need that documentation to prove the claim to their local customs authority.

4. Options for finding ROOs

India’s trade portal ( https://www.indiantradeportal.in ) rules of origin for each product under various trade agreements. To locate specific Rule of Origin, the exporter needs to provide HS code of the product and select the trade agreement to view the rules of origin. A second option is viewing the original ROOs in the official website of the Department of Commerce, Government of India. The full FTA text of various FTAs are available on the website (commerce.gov.in ).

Third Option: The Rules of Origin Facilitator provides user-friendly access to the International Trade Centre (ITC’s) database of rules of origin and origin provisions in trade agreements. The ITC’s Market Access Map currently contains data for more than 270 trade agreements applied by more than 190 countries as well as non-preferential regimes of the U.S., EU, and Switzerland.

5. Who are the authorised agencies in India for issuing the certificate of origin?

The authorised agencies in India for issuing the certificate of origin are listed in Appendix 35 of the Handbook of Procedures Vol-1 under the Foreign Trade Policy. Export Inspection Council (EIC), an autonomous organization under ministry of Commerce is primarily authorized to issue COOs under different FTA signed by India.

The recently introduced common digital platform (https://coo.dgft.gov.in/) is now a single point access for certificates of origin for all FTAs/PTAs for all agencies and all products. This is designed to facilitate exporters through a secure, electronic, paperless CoO issuance process.

6. Obtaining Certificate of Origin from EEPC India

EEPC India is authorized to issue Non-Preferential Certificate of Origin and preferential Certificate of Origin for SAPTA (SAARC Preferential Trading Agreement) and APTA [Preferential – Asia Pacific Trade Agreement]. Exporters need to visit CoO Portal (https://coo.eepcindia.com/coo/apply_now) of EEPC India to obtain these Certificates.

7. CAROTAR, 2020

The Customs (Administration of Rules of Origin under Trade Agreements) Rules, 2020 (CAROTAR, 2020), was notified on 21st August 2020 by the Central Board of Indirect Taxes and Customs. It came into force from 21st September 2020. CAROTAR 2020 (“Rules”) aims to add to the existing operational certification procedures which are prescribed under different trade agreements such as Free Trade Agreements (FTAs), Preferential Trade Agreement, Comprehensive Economic Cooperation Agreement and Comprehensive Economic Partnership Agreement.

Key features of CAROTAR 2020

- The extent of information expected to be possessed by an importer is defined.

- Importer is required to keep origin related information specific to each BE for minimum five years from date of filing B/E.

- Mandates inclusion of specific origin related information in B/E.

- Provides for scenario wherein verification from exporting country can be initiated.

- Sets timelines for receiving information from verifying authorities where same is not provided in Trade Agreements.

- Sets timelines for finalising decision based on information received from importer/verifying authorities.

Action which may be taken on import of identical goods, when it is determined that goods do not meet originating criteria.

8. Action which may be taken on import of identical goods, when it is determined that goods do not meet originating criteria.

Rule 3 of CAROTAR, 2020 mandates certain origin related details to be entered in the Bill of Entry, as available in the Certificate of Origin:

- Certificate of origin reference number;

- Date of issuance of certificate of origin;

- Originating criteria;

- Indicate if accumulation/cumulation is applied;

- Indicate if the certificate of origin is issued by a third country (back-to-back); and

- Indicate if goods have been transported directly from country of origin.

These additional fields in the Bill of Entry format are available from 21.09.2020. Likewise, changes have also been incorporated in the manual Bill of Entry format, to cater to customs stations where EDI facility is not available.